Equity Release in Runcorn

Equity release in Runcorn allows homeowners to access the value of their property. This financial solution can provide funds for various purposes, from home improvements to bolstering retirement income. It’s a decision with long-term consequences and requires understanding the details involved.

In this article, you will learn:

- How equity release can impact your financial situation

- The various types of equity release schemes available

- The process involved in releasing equity from your home

- The potential benefits and considerations of equity release

- Steps to take if you decide to pursue equity release

Equity Release in Runcorn

Equity release in Runcorn provides an opportunity for homeowners to unlock the value of their property. It’s a way to access cash without selling your home. People in Runcorn and the surrounding North West region, including North Wales and Ellesmere Port, are increasingly considering this option.

As a homeowner, you might find equity release a suitable solution if you require additional funds for your later life. It allows you to remain in your main residence while accessing the money tied to your property. This service is often provided by specialist equity release advisers who guide you.

Equity release in Runcorn involves several key players, including financial advisers, solicitors, and equity release providers.

These professionals ensure that the process is conducted per UK regulations, safeguarding your interests. They offer tailored advice based on your property type, financial situation, and long-term goals.

What is Equity Release

Defining Equity Release

Equity release is a financial service that allows homeowners to release equity from their homes. It is a loan secured against your property that does not require monthly repayments. Instead, the loan and any interest are repaid when you pass away or move into long-term care.

This option is popular among retirees in Runcorn looking for a tax-free lump sum or additional funds to complement their pension. It’s essential to understand how equity release works and its implications on your financial options and state benefits.

Types of Equity Release Schemes

There are mainly two types of equity release: lifetime mortgages and home reversion plans. A lifetime mortgage is a loan secured against your home, while a home reversion plan involves selling part or all of your property to a lender in exchange for a cash lump sum or regular payments.

Each scheme has its features, such as the negative equity guarantee with a lifetime mortgage, ensuring you never owe more than the value of your home. It is crucial to compare different equity release products and seek specialist equity release advice to find the best fit for your needs.

Eligibility Criteria for Homeowners

To be eligible for an equity release plan in Runcorn, you must be at least 55 years old and own a property of a specific value. The amount you can borrow depends on your age, the market value of your property, and your health status.

Providers also consider the type of property you own and any existing mortgage or loans secured against it. Seeking financial advice from an appointed representative registered on the Financial Services Register is vital in determining your eligibility.

Steps to Release Equity

Step 1: Seek Professional Advice

Before taking out an equity release scheme, it is essential to get professional advice. This advice helps you understand the equity release products available and the long-term impact on your finances.

A financial adviser can offer a personalised illustration of how much equity you can release and the best type of equity release for your situation.

Step 2: Choose a Suitable Scheme

After consulting with a financial adviser, the next step is to choose a scheme that aligns with your financial goals. Whether it’s a lifetime mortgage or a home reversion plan, the chosen scheme should offer easy access to funds while considering your desire for inheritance and tax position.

Step 3: Application and Property Valuation

Once you’ve selected a suitable equity release scheme, you must apply and have your property valued. The valuation fee is part of the overall costs and helps determine the property’s market value. This value, age, and health will influence the equity release loan amount you can secure.

Step 4: Legal Checks and Approvals

Legal checks and approvals ensure your equity release scheme complies with UK regulations. A solicitor can provide the necessary legal advice and help you understand the terms of the contract. They will also confirm that the scheme adheres to the guidelines set by the Equity Release Council.

Step 5: Receiving the Funds

The final step in the equity release process is receiving the funds. Once all checks are completed and the plan is approved, you can receive a tax-free lump sum or arrange for regular payments. It’s important to note that taking out an equity release plan is a lifetime commitment and should be considered carefully.

Try The Equity Release Calculator

Financial Implications

Impact on Inheritance

One of the most significant considerations when taking equity release is its impact on inheritance. Releasing equity reduces the value of your estate, which means there could be less for your heirs. Discussing your intentions with your family and ensuring they understand your decision is essential.

Equity Release Costs

The costs associated with equity release include advisor, valuation, and legal fees. There may also be early repayment charges if you decide to repay the equity release loan sooner than agreed. Understanding all the costs involved helps you assess the financial implications of releasing equity.

Interest Rates and Repayments

Interest rates for equity release schemes can be fixed or variable, and the rate you secure will affect the total amount owed over time.

With lifetime mortgages, interest builds up over the years as you are not making monthly repayments. This compound interest can grow significantly, so it’s vital to consider the long-term costs.

Legal Safeguards in Place

Equity Release Council Standards

The Equity Release Council sets standards for safe and fair equity release schemes. Their logo marks approval, indicating that a provider adheres to these standards. This includes ensuring you have the right to remain in your property for life and the presence of a no negative equity guarantee.

Right to Remain in Property

Equity release plans assure that you have the right to stay in your property until you pass away or move into long-term care. This safeguard is fundamental to the equity release agreement and provides peace of mind for homeowners.

No Negative Equity Guarantee

The no negative equity guarantee is a crucial feature of equity release schemes. It ensures that you or your estate will never owe more than the value of your home, even if the debt exceeds the property value due to falling market prices or rising interest.

Alternatives to Equity Release

Downsizing Your Home

Downsizing is an alternative to equity release, selling your home and moving to a smaller, cheaper property. This can free up cash and might be a more cost-effective way to release money tied up in your property without taking on a loan.

Borrowing Options

Other borrowing options include a residential mortgage or a credit card, which might suit some homeowners. These alternatives often require regular monthly payments, so comparing them with the no monthly payment feature of equity release is essential.

Government Schemes and Benefits

Homeowners could also consider government schemes and benefits, such as shared ownership or means-tested benefits that may offer financial support. Understanding how these options interact with equity release and your eligibility for such schemes is essential.

This article aims to provide a comprehensive understanding of equity release in Runcorn, exploring various schemes, the process, and the implications. Remember to seek professional advice and consider all options before making a decision.

Advantages and Disadvantages of Equity Release

Equity release in Runcorn can be a viable financial solution for many, but it’s essential to consider both the positives and negatives. In the following sections, you will find some key advantages and disadvantages of releasing equity from your home in Runcorn.

Advantages of Equity Release in Runcorn

Equity release can offer several benefits for homeowners in Runcorn. Let’s explore five key advantages.

1) Access to Tax-Free Cash

- Equity release in Runcorn offers a way to access a tax-free lump sum or regular income without moving house. This can enhance your financial flexibility in retirement.

- Releasing equity can provide the extra money needed for home improvements, long-term care, or to maintain a comfortable lifestyle.

2) No Monthly Repayments

- Unlike traditional loans, an equity release mortgage typically does not require monthly repayments. This can ease the financial burden on homeowners who are on a fixed income.

- The interest compounds over time and is only payable when the property is sold, usually when the client moves into care or passes away.

3) Stay in Your Home

- One of the main attractions of equity release is the ability to live in your home while accessing its equity. This means you can retain your independence and continue to live in familiar surroundings.

- Equity release schemes in Runcorn are regulated by the Financial Conduct Authority, ensuring that clients have the right to stay in their property for life, provided the property remains their primary residence.

4) Flexible Financial Planning

- Equity release provides flexible options for different needs, such as taking a lump sum or drawing smaller amounts when needed. This can be particularly useful for managing long-term care costs or providing a regular income.

- With the help of a specialist equity release adviser, you can tailor the scheme to your financial requirements, potentially preserving a portion of your property’s value for inheritance.

5) Negative Equity Protection

- Equity release products endorsed by the Equity Release Council have a ‘no negative equity guarantee’. This means you will never owe more than the value of your home, even if house prices fall.

- This guarantee provides peace of mind and ensures that an equity release is a safe option for homeowners, protecting the client and their beneficiaries.

Disadvantages of Equity Release in Runcorn

Despite the advantages, being aware of potential drawbacks is crucial. Here are five disadvantages to consider.

1) Reduced Inheritance

- Taking out an equity release plan can reduce the value of your estate, meaning there could be less for your heirs to inherit once the home is sold and the equity release provider is repaid.

- Potential beneficiaries should be involved in discussions about equity release, as the decision may affect their inheritance.

2) Impact on Means-Tested Benefits

- Releasing equity from your home may affect your eligibility for means-tested benefits. The extra cash could be counted as capital, reducing the financial support you can receive from the state.

- Before proceeding with equity release, it’s essential to understand how it could change your financial position about state benefits.

3) Early Repayment Charges

- Some equity release schemes may impose early repayment charges if you decide to repay the loan before the end of the plan. This can make it expensive to adjust your financial plans or move property.

- It’s vital to check the terms of your equity release product and discuss with your adviser the implications of these charges on your finances.

4) Compounding Interest

- The interest rate on an equity release loan can be higher than a typical residential mortgage. Since no payments are made until the end of the term, the amount owed can grow significantly over time.

- This compounding interest can consume a large portion of the sale proceeds of your property, leaving less for you or your heirs.

5) Restrictions on Property

- After taking equity release, there may be restrictions on what you can do with your property. For example, some providers may not allow certain types of renovation or may have conditions for selling the property.

- It’s essential to consider these potential restrictions and discuss how they might impact your plans for your property with your equity release adviser.

Equity Release Market Comparison in Runcorn

The equity release market in Runcorn has characteristics similar to those of other major towns and cities in the UK.

As a smaller town in the North West, Runcorn’s property market generally offers more affordable pricing than larger cities such as Liverpool or Manchester. This can influence the amount of equity homeowners can release from their properties.

Compared to nearby regions such as North Wales or Ellesmere Port, Runcorn has seen a steady increase in property values, although not as pronounced as in some parts of Northern Ireland or the more affluent areas of South East England.

Homeowners in Runcorn may find that while competitive, the equity release schemes available might not offer as high a loan-to-value ratio as those in areas with higher property values.

According to sources such as the Equity Release Council, the market trends and demand for equity release vary significantly across the UK.

Factors such as local economic conditions, demographic shifts, and housing market trends all play a role in shaping the equity release landscape in Runcorn compared to other areas.

Trends in Runcorn’s Equity Release

Looking at the trends within Runcorn’s equity release market, it’s clear that homeowners are interested in tapping into their property wealth. With an ageing population and pension pots not always stretching as far as hoped, equity release offers a viable supplement to retirement income.

Experts predict that equity release may become an increasingly attractive option as property prices continue to rise moderately in Runcorn.

The unique combination of more affordable housing and the potential for property value growth could make equity release a critical financial strategy for many in the area.

Forecasts suggest a cautious but steady increase in the uptake of equity-release products in Runcorn. This is backed by the growing presence of equity release advisers and providers in the North West, indicating a market responsive to the needs of the local population.

As always, homeowners are advised to seek professional advice to ensure that any equity release plan meets their specific needs and circumstances.

A Case Study on Runcorn Equity Release Experience

Here is a case study designed to illustrate how individuals in Runcorn might approach equity release, bringing the concept to life in a way many can relate. It aims to provide a realistic example of the considerations and steps involved in the process.

John, a 68-year-old retired teacher, has lived in Runcorn his entire life. He owns a three-bedroom house valued at £220,000 and is looking to release some equity to help fund his long-term care needs.

After using a free equity release calculator online, John learns he could access a tax-free lump sum from his property.

With no outstanding mortgage and a desire to leave an inheritance for his children, John is cautious about the decision. He visits a local equity release company to seek mortgage advice using a trading name he recognises.

The financial adviser, who has significant experience with cases in the North West, provides John with a personalised illustration of how equity release could work for him.

During the consultation, John learns about the potential impact of means-tested benefits and the importance of considering early repayment charges.

The adviser explained the equity release council logo, assuring John that it represents adherence to safe practices, including a no-negative equity guarantee.

Upon further discussions, John decides to proceed with a lifetime mortgage, taking a small tax-free cash upfront with the option for further drawdowns in his own time. This allows him to maintain his lifestyle and manage long-term care costs without making monthly interest payments.

The adviser also informs John about the financial ombudsman service, which adds a layer of security in case of any disputes.

Comforted by the knowledge that equity release is safe and regulated, John feels confident about his decision to access the equity in his home, knowing he has taken steps to ensure a secure financial future.

A Little About Runcorn

Runcorn, a town in the borough of Halton in Cheshire, England, is divided into several postcode areas, with the principal ones being WA7 and WA8. Runcorn’s local area telephone code is 01928, connecting it with the surrounding regions.

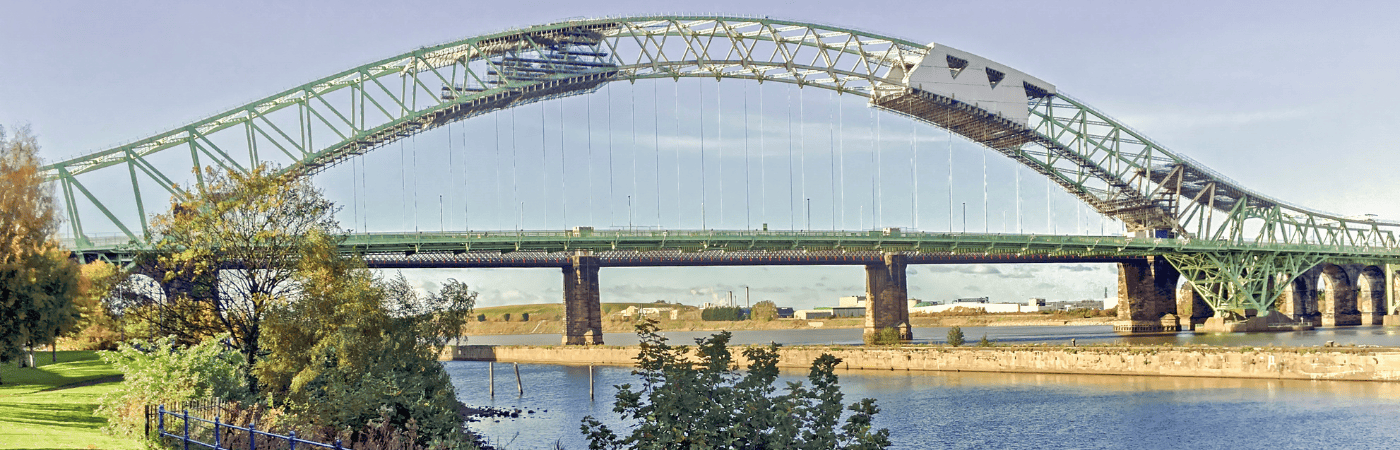

Runcorn is known for its industrial history and the iconic Silver Jubilee Bridge, a suspension bridge that crosses the River Mersey and the Manchester Ship Canal, linking the town with Widnes.

The town has a rich history dating back to the 10th century and has grown significantly through the years, especially during the Industrial Revolution.

Runcorn is also famous for its association with the chemical industry, which has been a significant part of the town’s economy since the late 19th century. Today, the area has diversified but still retains elements of its industrial heritage.

Local attractions in Runcorn include the Runcorn Hill Park and Nature Reserve, offering beautiful green spaces and opportunities for wildlife watching. The Brindley Theatre is a popular cultural venue showcasing a variety of performances and events.

For those interested in history, the Halton Castle ruins provide a glimpse into the past, situated atop Halton Hill with panoramic views of the surrounding area.

Runcorn is also home to the Norton Priory Museum and Gardens, Europe’s most excavated monastic site. The museum houses thousands of artefacts tracing Runcorn’s history, while the gardens offer a tranquil retreat with an extensive collection of plant species and a medieval herb garden.

Local Suburbs and Areas Where Equity Release Support Can Be Provided

- Halton Brook

- Halton Lodge

- Palacefields

- Windmill Hill

- Sandymoor

- Beechwood

- Daresbury

- Norton

- Castlefields

- Murdishaw

- Higher Runcorn

- Weston

- Weston Point

- Astmoor

- Brookvale

- Sutton Weaver

- Clifton

- Manor Park

- Heath

- Preston Brook

Key Takeaways and Learnings

To summarise, this article has examined the various aspects of equity release in Runcorn, providing homeowners with a detailed understanding of their options. The critical points of consideration have been highlighted to help you navigate this financial decision more clearly.

- Equity release in Runcorn can provide homeowners with a tax-free lump sum or additional income.

- The equity release market in Runcorn offers competitive options, though it varies compared to larger towns and cities.

- Professional advice from a qualified equity release adviser is crucial to navigate the process effectively.

- Equity release products like lifetime mortgages and home reversion plans have different features and implications.

- Homeowners should consider the impact of equity release on inheritance and means-tested benefits.

- Legal safeguards, including no negative equity guarantees, are in place to protect consumers.

- Alternative financial solutions to equity release, like downsizing or other loans, should be evaluated.

- It’s essential to understand the fees involved, such as valuation, legal, and potential early repayment charges.

- Runcorn’s local attractions and amenities add to the town’s appeal for residents considering equity release.

In conclusion, equity release in Runcorn can be a beneficial financial option for many, but it requires careful consideration and planning. Before deciding, homeowners should consider the financial implications, legal safeguards, and potential alternatives.

With the right advice and a clear understanding of the process, equity release can be a viable way to access the wealth tied up in your home.